Bent Finance - REKT

This time, it seems, due to structural failure from within.

Bent Finance is a "staking and farming platform to enhance your curve returns."

Over the past few weeks, one address has been bending the rules of the protocol, extracting ~$1.75M before things were straightened out.

When the news broke, and the price of $BENT buckled, the team issued a luke-warm warning informing users that rewards had been paused, but no funds had been lost.

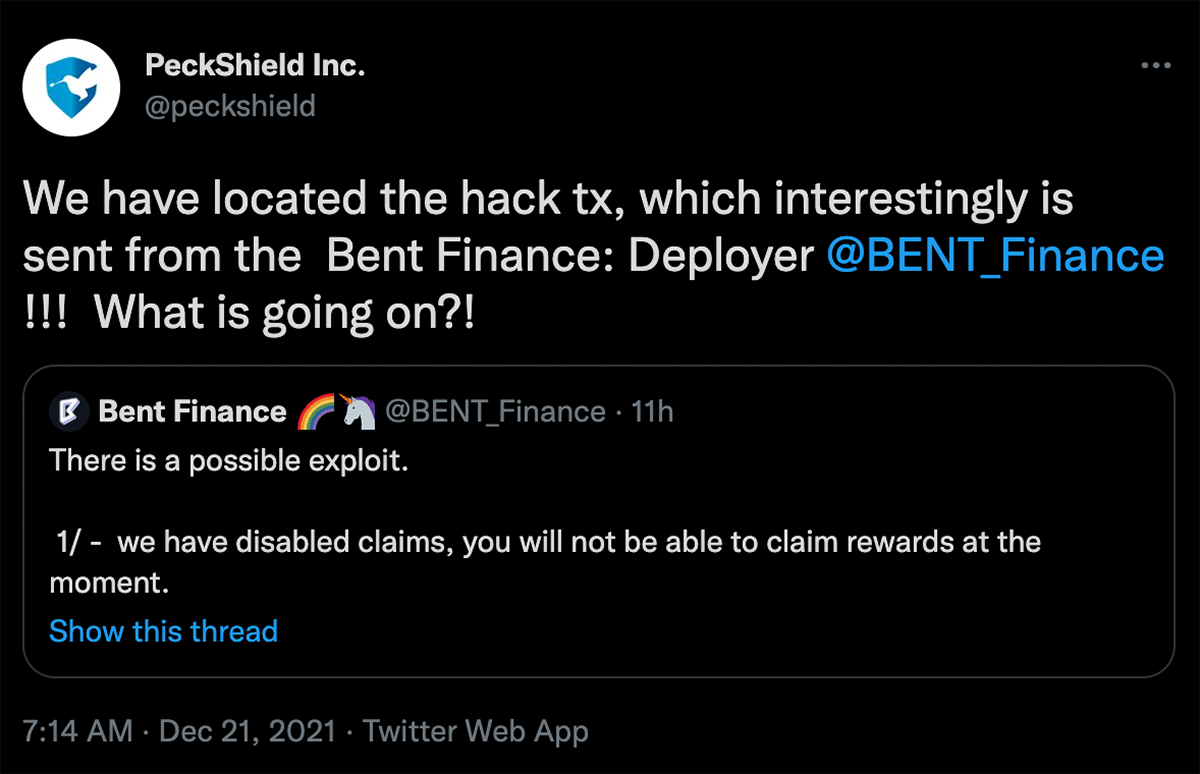

However, when PeckShield claimed to have identified the exploit as coming from within…

…the team was forced to release an update, which could be read as accusations of an inside job:

Credit: BlockSecTeam

Rather than a technical smart contract manipulation, this case is far more simple.

Bent Finance cvxCRV contract was updated on Nov. 30, manually adjusting the balance of the exploiter’s address.

This assigned the exploiter enormous amounts of rewards, far exceeding the TVL of Bent Finance itself.

Despite the exploit being live for almost three weeks, the problem only became clear with Bent Finance’s recent listing on DeBank, when the exploiter’s wallet profile showed the billions of dollars-worth of pending rewards on the platform.

Looking at the main wallet’s token transactions, we see a handful of small deposits, followed by some very large withdrawals, one on Dec. 12 (of 263k cvxcrv-f) and another today at 02:45 AM +UTC (of 250k cvxcrv-f).

The tokens were then sent on to the exploiter’s secondary address, where they were cashed out for CRV, swapped for ETH and sent to Tornado Cash.

In total, 440 ETH (~$1.75M) has been washed via Tornado Cash between 12/12 and today.

The role that DeBank’s listing of Bent Finance played in today’s case and Nansen’s recent $75M raise show the value that these services bring to an increasingly more complex industry.

Although on-chain data provides all the necessary information to those with the knowledge (and motivation) to investigate, these tools vastly increase the probability of spotting irregularities in lower profile projects.

However, in the case of Bent Finance, given the source of the exploit, as well as the team’s response, this looks likely to be an inside job:

Rug pull or rogue team member?

Much bigger hacks have dominated the headlines recently, and incidents such as this will soon be forgotten.

Maybe that’s what the Bent Finance team is counting on…

REKT serves as a public platform for anonymous authors, we take no responsibility for the views or content hosted on REKT.

donate (ETH / ERC20): 0x3C5c2F4bCeC51a36494682f91Dbc6cA7c63B514C

disclaimer:

REKT is not responsible or liable in any manner for any Content posted on our Website or in connection with our Services, whether posted or caused by ANON Author of our Website, or by REKT. Although we provide rules for Anon Author conduct and postings, we do not control and are not responsible for what Anon Author post, transmit or share on our Website or Services, and are not responsible for any offensive, inappropriate, obscene, unlawful or otherwise objectionable content you may encounter on our Website or Services. REKT is not responsible for the conduct, whether online or offline, of any user of our Website or Services.

you might also like...

Team Finance - REKT

There’s no $ in Team. Four projects got rugged through their shared anti-rug mechanism. $15.8M lost, and number 46 on the leaderboard. Go Team.

Moola Market - REKT

Bear markets offer easy opportunities to market manipulators, who find it easier to move prices when liquidity is low. Lending protocol Moola Market is the latest to fall victim to a “highly profitable trading strategy”, and the first CELO protocol on the rekt.news leaderboard (#63).

Mango Markets - REKT

Solana’s flagship margin trading protocol lost 9 figures to a well-funded market manipulator. The attacker managed to spike the price of Mango Markets’ native token MNGO and drain their lending pools, leaving the protocol with $115M of bad debt.