Team Finance - REKT

Four projects got rugged through their shared anti-rug mechanism.

Team Finance, the self-proclaimed “Industry Leader In Project Security & Automation”, lost $15.8M of funds that it was supposed to be safeguarding.

Of the four pools drained, FEG, Caw, and Kondux were the worst hit. Tsuka was also affected, but experienced less price impact due to a secondary liquidity pool on Uniswap v3.

The project’s website claims to protect over $2.5B of assets, but considering the low liquidity of their selection of shitcoins, we can consider this claim to be optimistic at best.

#46 on the leaderboard.

Teamwork.

Credit: Peckshield

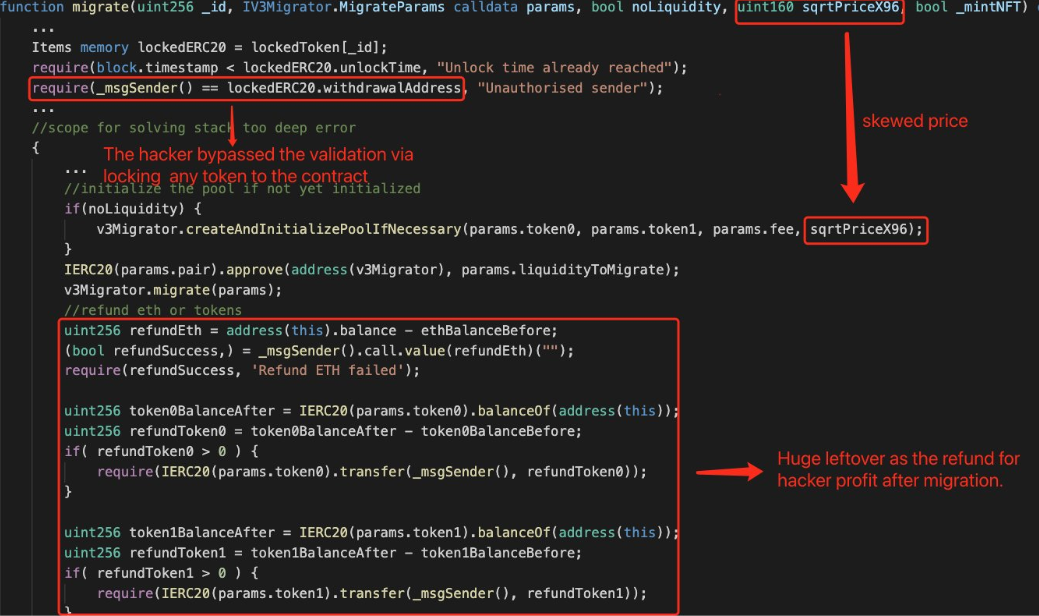

The announcement of the hack explained that the exploit targeted “the audited v2 to v3 migration function.”

The vulnerability was contained in one of the Liquidity Locks’ “bulletproof smart contracts” which allowed projects to migrate locked LP positions from Uni v2 to Uni v3.

According to Peckshield’s analysis:

The protocol has a flawed migrate() that is exploited to transfer real UniswapV2 liquidity to an attacker-controlled new V3 pair with skewed price, resulting in huge leftover as the refund for profit. Also, the authorized sender check is bypassed by locking any tokens.

The breakdown of the loss to each project’s Uniswap v2 pool is as follows:

$11.5M CAW

$1.7M TSUKA

$0.7M KNDX

$1.9M FEG

Exploiter address 1: 0x161cebb807ac181d5303a4ccec2fc580cc5899fd

Exploiter address 2 (containing stolen funds): 0xba399a2580785a2ded740f5e30ec89fb3e617e6e

Attack tx: 0xb2e3ea72…

Attacker’s contract: 0xcff07c4e6aa9e2fec04daaf5f41d1b10f3adadf4

The vulnerable migrate() function was included in Zokyo Security’s audit of Team Finance contracts from August this year.

“DAO tooling” was amongst the most popular buzzwords throughout the last cycle.

For small, anon teams working on innovative protocols, it may be tempting to outsource trust to a third party. But given the array of shitcoins “secured” by Team Finance, the vaults seem more likely to be a way for projects to appear trustworthy by proxy.

Now that it’s clear that trust has been lost.

Will this protocol take one for the team and reimburse the victims, or is it every man for himself?

There’s no $ in Team.

REKT serves as a public platform for anonymous authors, we take no responsibility for the views or content hosted on REKT.

donate (ETH / ERC20): 0x3C5c2F4bCeC51a36494682f91Dbc6cA7c63B514C

disclaimer:

REKT is not responsible or liable in any manner for any Content posted on our Website or in connection with our Services, whether posted or caused by ANON Author of our Website, or by REKT. Although we provide rules for Anon Author conduct and postings, we do not control and are not responsible for what Anon Author post, transmit or share on our Website or Services, and are not responsible for any offensive, inappropriate, obscene, unlawful or otherwise objectionable content you may encounter on our Website or Services. REKT is not responsible for the conduct, whether online or offline, of any user of our Website or Services.

you might also like...

Moola Market - REKT

Bear markets offer easy opportunities to market manipulators, who find it easier to move prices when liquidity is low. Lending protocol Moola Market is the latest to fall victim to a “highly profitable trading strategy”, and the first CELO protocol on the rekt.news leaderboard (#63).

Mango Markets - REKT

Solana’s flagship margin trading protocol lost 9 figures to a well-funded market manipulator. The attacker managed to spike the price of Mango Markets’ native token MNGO and drain their lending pools, leaving the protocol with $115M of bad debt.

TempleDAO - REKT

TempleDAO’s STAX was hacked for approximately $2.3M worth of LP tokens. The vulnerable contract had been live for four months. Why did it take so long to be exploited?